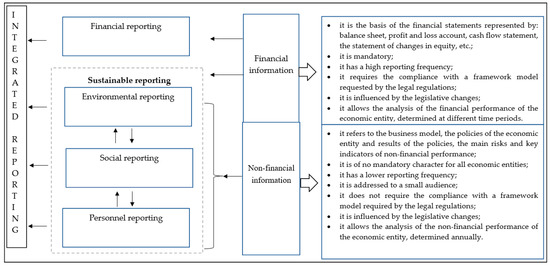

Sustainability | Free Full-Text | Impact of Non-Financial Information on Sustainable Reporting of Organisations' Performance: Case Study on the Companies Listed on the Bucharest Stock Exchange

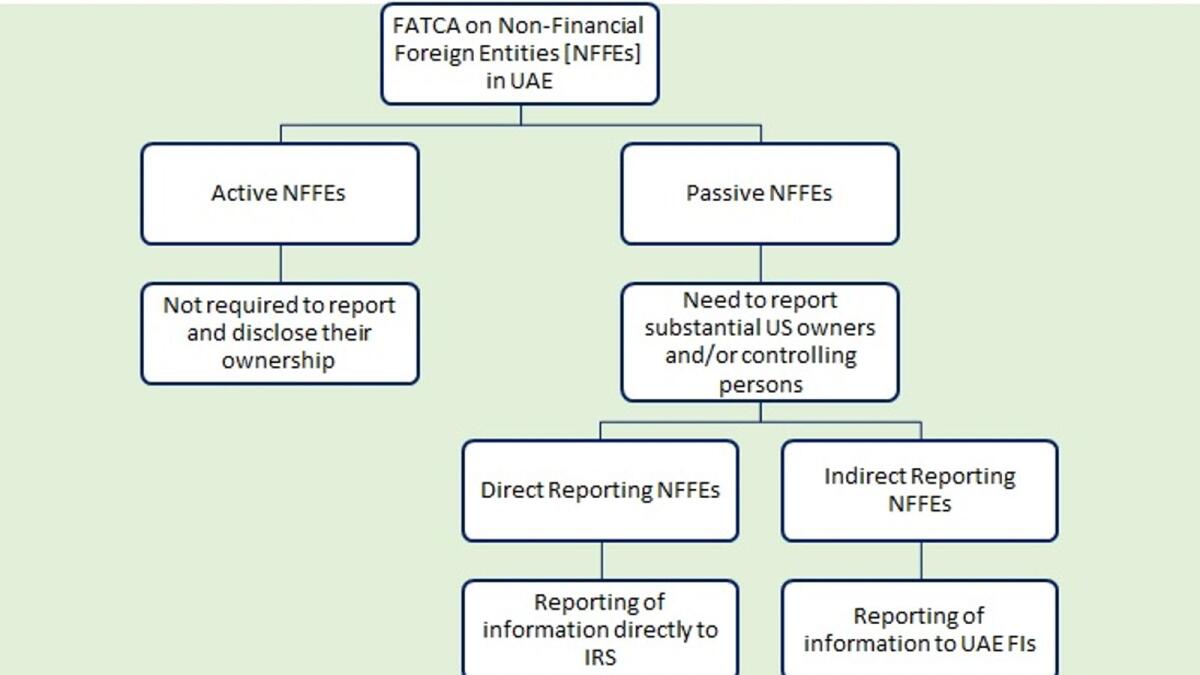

Monzo Business: Active vs Passive Non-Financial Entities (NFEs) - Business Banking - Monzo Community

:max_bytes(150000):strip_icc()/dotdash-040615-what-difference-between-residual-income-and-passive-income-final-ead4eaafb219438c98555810177928c7.jpg)